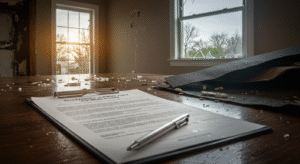

What Does Your Damage Look Like? What Can or Can’t Be Covered in Your Insurance Policy?

Understanding what damage your insurance policy covers can be like navigating a complex maze. Have you ever found yourself wondering if your policy covers all scenarios? Let’s delve into this intriguing topic together.

The HomeOwner’s Advocate offers insights that might surprise you. There’s much to consider, from standard exclusions like intentional damage or acts of war to hidden coverage options like identity theft protection. What could you be missing that might leave you vulnerable? It’s essential to be aware of these potential gaps in your coverage to avoid any unpleasant surprises.

Let’s uncover the intricacies of insurance coverage that could make all the difference when the unexpected strikes.

Understanding Policy Coverage Limits

Understanding your insurance policy coverage limits is not just a matter of knowledge, it’s a crucial step towards ensuring you’re adequately protected in the event of a loss. This applies to various insurance policies, such as home, auto, and liability insurance. Regarding liability coverage limits, knowing the maximum amount your policy will pay for liability claims is vital. This can include legal fees, medical expenses, and damages awarded in a lawsuit. Failing to know these limits could potentially lead to significant financial strain in the case of a liability claim. It’s time to take control of your coverage.

Understanding your coverage limits is not just about being informed, it’s about taking control of your financial security. Your insurance policy may have specific limits on how much it will pay for property damage, such as damage to buildings, equipment, or inventory. Knowing these limits can empower you to plan and prepare for potential out-of-pocket expenses in the event of a claim. Don’t let the unexpected catch you off guard, be in control of your coverage.

When it comes to your business, being informed about the coverage limits for business interruption is not just important, it’s urgent. It can help you manage the financial impact of a temporary closure or relocation. Review your policy to understand the extent of coverage available and consider any additional coverage options necessary to protect your business entirely. Don’t wait for a crisis to strike, be proactive in protecting your business.

Identifying Exclusions in Your Policy

To guarantee full awareness of potential limitations in your insurance coverage, carefully identify any exclusions outlined in your policy document. While standard insurance policies often cover property damage and business interruption, it’s essential to recognize that liability claims, flood and earthquake damage, wear and tear, and specific personal property may be excluded.

Typical policies don’t encompass flood or earthquake damage, necessitating separate flood or earthquake insurance if you reside in high-risk areas. Remember, insurance isn’t intended for routine maintenance or wear and tear; it focuses instead on sudden and accidental damage. Review your policy to understand coverage limitations, such as intentional acts or specific types of liability.

Unveiling Hidden Coverage Options

Discover the lesser-known coverage options concealed within your insurance policy to maximize asset protection.

- Property Damage: Your policy may cover the physical structure, equipment, inventory, and other assets damaged by fire, vandalism, or natural disasters.

- Business Interruption: Look for coverage compensating for lost income and ongoing expenses if your business is temporarily closed due to a covered event.

- A.L.E. ( Additional Living Expenses): Compensation for costs incurred due to temporary housing and other expenses during property damage recovery. Sometimes included in your policy’s “Coverage – D”.

- Liability Claims: Ensure you’re protected financially from injury claims on your property or accusations of causing harm, covering legal fees, medical expenses, and damages awarded.

- Flood and Earthquake Damage: Standard policies usually exclude these events. Consider purchasing separate flood or earthquake insurance for adequate protection in susceptible areas.

Review your policy carefully to uncover these hidden coverages, safeguarding your property, business operations, and financial well-being. Don’t overlook these essential options when evaluating your insurance coverage to ensure thorough protection against unforeseen events.

Types of Damage Often Covered

Most insurance policies cover property damage caused by events like fire, vandalism, or natural disasters. This category includes damage to buildings, equipment, inventory, and other assets. Standard policies commonly offer coverage for property damage, but the specifics can vary based on the policy terms.

Business interruption coverage is another essential aspect often included. It compensates for lost income and ongoing expenses when a business needs to close temporarily due to a covered event. Liability claims coverage helps protect against financial repercussions from injuries on your property or harm caused by your business.

Flood and earthquake damage, however, are usually not covered by standard policies, necessitating additional coverage. It’s important to note that insurance addresses sudden and accidental damage, not wear and tear or routine maintenance.

Personal property coverage under homeowners’ insurance can protect belongings like furniture and electronics from theft or fire, with potential limits on specific items requiring additional endorsements for complete protection. Regularly reviewing damage and examining your policy can ensure you have adequate coverage.

Commonly Misunderstood Policy Inclusions

Many policyholders often misunderstand what specific inclusions their insurance policies offer. Here are some commonly misunderstood policy inclusions to guarantee you have a clear understanding:

Personal Property Coverage Limits

Review your policy to understand the limits on coverage for personal belongings like jewelry or artwork. Consider additional endorsements to protect valuable possessions adequately.

Types of Damage

Be mindful of the various types of damage covered by your standard homeowner’s insurance policy, such as fire, theft, or certain natural disasters.

Extra Coverage

Explore options for extra insurance coverage beyond the standard policy, especially for events like floods or earthquakes that may require a separate policy.

Liability Insurance

Understand the coverage for damage caused by your business or property, including protection against liability claims for injuries or property damage. Stay informed about exclusions or limitations related to intentional acts or specific liabilities.

Steps to Enhance Your Insurance Coverage

Consider improving your insurance coverage by examining your policy for potential gaps and exploring additional coverage options. Start by evaluating your insurance coverage for property damage, ensuring that your policy protects your buildings, equipment, and inventory from risks like fire, vandalism, and natural disasters.

Evaluate the extent of coverage for business interruptions to safeguard your income and expenses in case of a temporary closure or relocation due to a covered event. Additionally, understand the implications of liability claims on your financial security and be aware of any exclusions or limitations in your policy.

Since standard policies often exclude flood and earthquake damage, consider obtaining separate coverage for these risks if you reside in susceptible areas. Remember that insurance typically covers sudden and accidental damage, not wear and tear, underscoring the importance of proactive maintenance.

Proactive Insurance Management Made Easy

In today’s unpredictable world, safeguarding your assets is paramount. That’s why it’s crucial to manage your insurance coverage proactively. Take the time to review your policy thoroughly, understand your coverage limits, and identify any exclusions. Don’t leave your financial well-being to chance – explore hidden options for comprehensive protection. Act now to mitigate potential damage or losses before they occur.

Don’t wait until it’s too late.