Table of Contents

The Push for Accountability in Hurricane Insurance

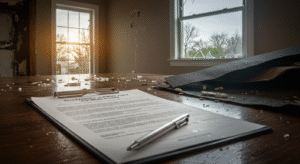

Recent hurricanes have left Florida and Southeastern homeowners grappling with extensive property damage and challenging insurance claims. In response, Congressional representatives Jamie Raskin, Maxwell Alejandro Frost, and Jared Moskowitz have demanded greater transparency and accountability from insurance companies operating in states like Florida, Georgia, South Carolina, Tennessee, and North Carolina.

These actions follow troubling revelations from a 60 Minutes investigation, which exposed

unethical practices such as:

- Payout reductions of up to 97%.

- Manipulated adjuster reports to minimize losses.

- Wrongful denial of claims by misattributing damages to flooding instead of

wind.

Congressional oversight is aimed at ensuring victims of Hurricanes Helene and Milton are treated fairly and receive the compensation they deserve.

What Congress is Doing to Help

To address these widespread issues, lawmakers have requested that state insurance regulators

take action. Their proposals include:

1. Document Preservation

- Keep detailed records of discrepancies between initial damage estimates and

payouts. - Retain communications explaining why payouts were reduced.

- Identify individuals involved in altering claims.

2. Accountability for Claims Denials

- Investigate cases where damage was wrongfully attributed to flooding,

affecting coverage eligibility.

3. Oversight Mechanisms

- Conduct regular spot checks on claims adjustment processes.

- Require insurance companies to submit detailed claims reports to regulators.

Why This Matters to Homeowners in Florida and the Southeast

These measures aim to restore trust in the insurance claims process for homeowners in

hurricane-prone areas like Bradenton, FL, and the Southeastern United States. As extreme

weather events increase in frequency and intensity, reliable insurance coverage is crucial for

recovery.

For homeowners, these developments provide reassurance that federal and state governments

are monitoring insurers closely. By holding companies accountable, the goal is to ensure policyholders are not left at a disadvantage when filing hurricane insurance claims.

Tips for Navigating Hurricane Insurance Claims

If you are a homeowner in Florida or the Southeast facing hurricane damage, here are some tips to protect your rights and maximize your payout:

- Document Everything: Photograph and video all damage to your property. Keep a detailed log of communications with your insurer, including dates and names of representatives.

- Understand Your Policy: Familiarize yourself with your coverage, especially exclusions for hurricane-related damage.

- Stay Informed: Follow legislative updates from Florida and other Southeastern states to understand how new regulations might affect your claims.

Get Help From a Local Advocate in Bradenton, FL

Dealing with insurance companies can be overwhelming, especially when you feel your claim is

undervalued or denied. Fortunately, local help is available.

Jeffrey Von Stein, CPIA, AIC, CRE

Chief Visionary & Managing Director of Relations

The HomeOwner’s Advocate

- Mobile: 850-901-5717

- Direct: 855-FAIR-CLAIM

- Email: jeffrey@thehomeownersadvocate.com

- Office Location: 4916 26th St W Suite 150, Bradenton, FL 34207

At The HomeOwner’s Advocate, based in Bradenton, FL, we specialize in helping Floridahomeowners navigate the complexities of hurricane insurance claims. Whether you are facing delays, unfair settlements, or outright denials, we are here to fight for the compensation you deserve. Contact us today to discuss your situation.

Final Thoughts

As hurricanes become more frequent, it is critical for Florida and Southeastern homeowners to understand their insurance rights. Stay proactive by documenting damage thoroughly, knowing your policy inside and out, and seeking professional guidance when necessary. With the right support, you can navigate the claims process more confidently and ensure your insurer fulfills its obligations.