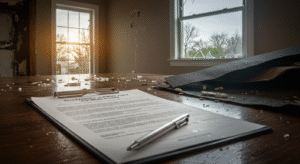

Receiving a low settlement offer from your insurance company after property damage can feel like a second disaster. When your Florida home suffers damage from hurricanes, floods, fire, or other covered perils, you expect your insurance policy to provide adequate compensation for repairs. Unfortunately, many homeowners discover that their insurer’s initial settlement offer falls significantly short of actual repair costs.

If you are facing an inadequate insurance settlement in Florida, understanding your options—including when and how to hire a public adjuster—can make the difference between financial hardship and fair compensation.

Understanding Why Insurance Settlements Fall Short

Insurance companies are businesses focused on minimizing payouts while maximizing profits. Several factors contribute to low settlement offers:

Undervalued Damage Assessments: Insurance adjusters working for your carrier may overlook hidden damage, underestimate repair costs, or use depreciated values that don’t reflect current replacement costs.

Policy Interpretation Disputes: Insurers may interpret policy language narrowly, claiming certain damages are not covered or applying exclusions that should not apply to your situation.

Rushed Inspections: After major weather events in Florida, insurance adjusters may be overwhelmed with claims, leading to incomplete inspections and inadequate damage documentation.

Calculation Methods: Some insurers use software programs or databases that don’t accurately reflect Florida’s construction costs, particularly in areas with high demand following widespread disasters.

Your Rights Under Florida Insurance Law

Florida law provides important protections for policyholders dealing with property insurance claims:

Duty of Good Faith: Under Florida Statutes § 624.155, insurance companies must handle claims in good faith and cannot unreasonably delay or deny legitimate claims. Violating this duty can result in penalties and bad faith lawsuits.

Right to Independent Representation: You have the legal right to hire a public adjuster to represent your interests in the claims process. Your insurance company cannot require you to use their adjuster’s assessment.

Appraisal Rights: Most Florida homeowners insurance policies include an appraisal clause allowing either party to request independent appraisal when there’s a dispute over the amount of loss.

Time Limits for Insurers: Florida law requires insurers to acknowledge claims within 14 days and investigate most claims within 90 days, ensuring timely responses to your property damage.

What Is a Public Adjuster?

A public adjuster is a licensed professional who works exclusively for policyholders—not insurance companies. Unlike the adjuster sent by your insurance carrier, a public adjuster advocates for your best interests throughout the claims process.

Public adjusters in Florida must be licensed by the Department of Financial Services and are regulated under Florida Statutes Chapter 626. Their expertise includes:

– Thoroughly documenting all property damage

– Interpreting complex policy language

– Calculating accurate repair and replacement costs

– Negotiating with insurance companies on your behalf

– Preparing detailed claim documentation

– Managing the entire claims process from start to finish

The key distinction: your insurance company’s adjuster works to minimize what they pay out, while a public adjuster works to maximize what you receive.

Signs You Need a Public Adjuster in Florida

Consider hiring a public adjuster if you encounter any of these situations:

The Settlement Offer Is Significantly Lower Than Expected: If your insurer’s offer doesn’t come close to covering your repair costs, a public adjuster can reassess the damage and negotiate for fair compensation.

Your Claim Is Complex: Large losses, commercial properties, or claims involving multiple types of damage (such as wind and water damage from hurricanes) often require professional expertise to document properly.

Your Claim Has Been Denied or Underpaid: If the insurance company denies coverage or offers an unreasonably low amount, a public adjuster can review the denial, identify errors, and build a stronger case.

You Don’t Have Time to Manage the Process: Filing insurance claims requires significant time and expertise. If you’re overwhelmed or lack experience with insurance claims, a public adjuster handles everything for you.

The Insurance Company Is Delaying: If your insurer is stalling, requesting excessive documentation, or missing deadlines, a public adjuster can apply pressure and expedite the process.

You are Uncomfortable Negotiating: Many homeowners lack the knowledge or confidence to negotiate effectively with insurance companies. Public adjusters are experienced negotiators who understand claim valuation and carrier tactics.

The Public Adjuster Process: What to Expect

When you hire a public adjuster in Florida, here’s what typically happens:

Initial Consultation and Contract

Most public adjusters offer free consultations to evaluate your claim. During this meeting, they’ll review your policy, assess the damage, and explain how they can help. If you decide to proceed, you’ll sign a contract outlining their fee structure (typically a percentage of the settlement increase) and services.

Comprehensive Damage Assessment

Your public adjuster will conduct a thorough inspection of your property, documenting all damage with photographs, measurements, and detailed notes. They often identify damage that the insurance company’s adjuster missed or undervalued.

Claim Preparation and Submission

The public adjuster prepares a comprehensive claim package including detailed estimates, supporting documentation, and policy analysis. This professional presentation strengthens your position and demonstrates the true value of your loss.

Negotiation and Settlement

Your public adjuster negotiates directly with the insurance company, responding to requests for additional information and advocating for maximum compensation. They understand claim valuation methods and carrier tactics, positioning you for the best possible outcome.

Resolution

Once an agreement is reached, your public adjuster ensures all paperwork is properly completed and you receive your settlement payment. They continue advocating for you until the claim is fully resolved.

How Much Does a Public Adjuster Cost in Florida?

Florida law regulates public adjuster fees under Florida Statutes § 626.854. Key points about fees:

Percentage-Based Compensation: Public adjusters typically charge a percentage of the insurance settlement, usually ranging from 10% to 20% depending on the claim’s complexity and timing.

Hurricane and Emergency Fees: For claims filed within one year of a governor-declared state of emergency, Florida law caps public adjuster fees at 10% of the insurance settlement amount.

No Upfront Costs: Most public adjusters work on a contingency basis, meaning you pay nothing unless they increase your settlement. This arrangement aligns their interests with yours.

Written Contracts Required: Florida law requires all public adjuster contracts to be in writing, clearly stating the fee structure and services provided.

Before hiring a public adjuster, review the contract carefully and ensure you understand the fee arrangement and what services are included.

Evaluating Whether to Hire a Public Adjuster

Not every insurance claim requires a public adjuster. Consider these factors when deciding:

Claim Size: For smaller claims (under $10,000), the public adjuster’s fee may not be worthwhile. However, for larger claims, their expertise often results in significantly higher settlements that far exceed their fee.

Your Expertise and Time: If you have construction knowledge, understand insurance policies, and have time to manage the process, you might handle the claim yourself. Most homeowners lack this combination of skills.

Initial Offer Gap: Calculate the difference between the insurer’s offer and your estimated repair costs. If there is a large gap, a public adjuster can negotiate a much better settlement.

Claim Complexity: Complex claims involving structural damage, multiple perils, code upgrades, or business interruption almost always benefit from professional representation.

Settlement Amount: Many public adjusters increase settlements by 70% to 200% or more. Even after their fee, you typically receive substantially more than the original offer.

Steps to Take When Facing a Low Settlement

If your insurance company offers an inadequate settlement, follow these steps:

1. Do not Accept Immediately: You are not obligated to accept the first offer. Taking time to evaluate ensures you don’t settle for less than you deserve.

2. Document Everything: Take photographs, save receipts, and keep detailed records of all damage and communications with your insurer.

3. Get Independent Estimates: Obtain repair estimates from licensed Florida contractors to compare with the insurance company’s valuation.

4. Review Your Policy: Carefully read your insurance policy to understand your coverage, limits, and any applicable deductibles or exclusions.

5. Consult a Public Adjuster: Schedule free consultations with licensed public adjusters to understand your options and potential settlement increases.

6. Submit a Written Response: If you disagree with the settlement offer, send a written response to your insurance company explaining why the offer is inadequate.

7. Consider Legal Options: If negotiations fail, you may need to pursue appraisal or legal action. Public adjusters often work alongside attorneys when necessary.

Choosing the Right Public Adjuster in Florida

When selecting a public adjuster, look for:

Valid Florida License: Verify the adjuster holds an active license through the Florida Department of Financial Services website.

Experience with Similar Claims: Choose an adjuster with specific experience handling your type of claim (hurricane damage, fire loss, water damage, etc.).

Local Knowledge: Florida-based public adjusters understand state-specific regulations, construction costs, and insurance company practices in your area.

Transparent Fee Structure: The contract should clearly explain fees, with no hidden costs or unexpected charges.

Professional References: Ask for references from past clients and check online reviews to assess their reputation and success rate.

Clear Communication: Your public adjuster should explain the process clearly, respond promptly to questions, and keep you informed throughout the claim.

Common Mistakes to Avoid

When dealing with a low insurance settlement, avoid these pitfalls:

– Accepting the First Offer: Initial settlements are often negotiable and may be significantly lower than what you deserve.

– Missing Deadlines: Florida insurance policies contain strict deadlines for filing claims, requesting appraisals, or taking legal action. Missing these deadlines can forfeit your rights.

– Making Unauthorized Repairs: Before making permanent repairs, document all damage and get approval from your insurer to avoid coverage disputes.

– Providing Recorded Statements Without Preparation: Be cautious when your insurance company requests recorded statements, as your words can be used against you.

– Hiring Unlicensed Adjusters: Only work with properly licensed public adjusters to ensure professional standards and legal protections.

Take Control of Your Insurance Claim

Receiving a low settlement offer does not mean you are stuck with inadequate compensation. Florida homeowners have rights, options, and resources to fight for fair treatment from insurance companies.

Whether you are dealing with hurricane damage, fire loss, water damage, or any other covered peril, a qualified public adjuster can level the playing field against insurance companies and their teams of adjusters, attorneys, and experts.

If your insurance settlement offer falls short of covering your damages, do not settle for less than you deserve. A consultation with an experienced Florida public adjuster can help you understand your claim’s true value and the best path forward to protect your property and financial security.

The Homeowners Advocate specializes in representing Florida homeowners throughout the insurance claims process. Our licensed public adjusters have extensive experience maximizing settlements for property damage claims across Northern Florida Regional. Contact us today for a free consultation to discuss your insurance claim.