There are a number of things people update periodically: Their wardrobe. Their resume. Their Facebook status. Their phone. But what about their HomeOwners Insurance policy? Those who only take a good look at their coverage when they first buy their home or when they’re shopping around for a new insurer could be missing out on both essential coverages and Potential Savings.

A good place to begin when evaluating homeowners coverage is with creating a thorough home inventory and updating it every few months. Advice from the Florida Department of Insurance suggests a simple way to do this is to encourage insureds to walk around their home with a video camera, recording everything in their house (including inside of drawers) and providing commentary on the items as they go. Of course, they can also utilize things like apps or good-old-fashioned pen and paper to create their inventory.

Once it is complete, it’s important to store the inventory in a place where it isn’t vulnerable to potential losses to the home; like in a fire resistant container, in a locked cabinet at their workplace, with a close friend or family member, with their accountant or lawyer, or in a safety deposit box.

In the slideshow above, we’ll look at seven instances when a person should consider updating their homeowners insurance policy, according to Quorum.

When the Square Footage Increases:

Any time an addition is added onto a home, whether it be an extra bedroom, attaching a garage, adding a back porch, or any number of other additions, the home will increase in Value. This means your HomeOwners coverage will need to increase in order so your wont be under-insured and your home is Fully Covered.

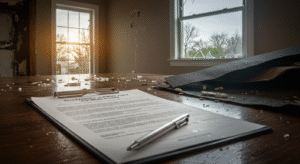

When you have Renovations:

Even is a home improvement project doesn’t add space, it will still add value. It’s integral to make sure homeowners coverage is sufficient to cover any new improvements.

When Security Increases:

Adding security features to a home, like deadbolt locks, a security system or fire alarms can sometimes land an insured discounts on their premiums, so it’s best to keep their agent updated on these improvements.

When Someone Moves In:

HomeOwners policies include Liability Coverage for everyone living in the home, so insurers should be informed of any changes to a household’s makeup so coverage is sufficient.

When New Roof is installed:

Since most HomeOwners Polices focus on roof age and condition, installing a new roof will lower you insurance premiums dramatically. Notify insurance carrier of permitted roof replacement and obtain a 4 Wind inspection and send to insurance carrier.

For a thorough Review of your Insurance Policy before a Disaster Strikes, please call The HomeOwner’s Advocate for advice of “Potential Pitfalls” in your Policy.

http://www.TheHomeOwnersAdvocate.com

Call 855-FAIR-CLAIM