12 Reasons to Hire an Axperienced PA

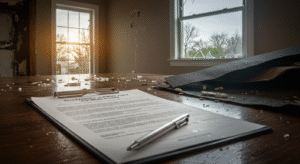

In the aftermath of a Tornado, you’re probably dealing with more than just physical property damage—navigating the insurance maze may be emotionally draining as well. But there is some good news: you do not have to go through this process alone. Public adjusters can simplify paperwork, speed up payouts, and maximize your claim. Keep reading for our ’12 Reasons You Should Hire a Public Adjuster,’ your key to a smoother recovery.

1. A claim for a total loss of a house can cost less than rebuilding a damaged house.

2. If you have a mortgage, your insurance checks will be made out to you and your mortgage bank.

3. Don’t cash any insurance checks marked “full and final settlement.”

4. Don’t sign a release on your home insurance claim.

5. Don’t let your insurance company replace your Pottery Barn stuff with Walmart stuff.

6. Many condo owners have no idea that they need their own home insurance policies.

7. If there’s a mandatory evacuation, your home insurance covers your “additional living expenses”, including hotels and food.

8. After a widespread disaster, insurance companies will bring in company adjusters from out of state who aren’t familiar with local costs.

9. People regularly settle for less than the total cost of their damages because they are exhausted.

10. A public adjuster’s worth hiring. In addition to handling several meetings, emails, phone calls, and paperwork that are required for a claim, they’ll will also explain the procedure and act on your behalf.

11. Public adjuster fees are based on a percentage of your total claim, which gives them incentive to maximize your insurance payments.

12. Why not just hire a Roofer who knocks on my Door? These roofers often focus on volume, not your best interests. While they may offer to handle your insurance claims, doing so is actually a 3rd Degree Felony in Florida.

We provide Expert & Personal Advocacy to Clients to save them Time, Stress, Frustration, Money, and Complications.

Best Regards,

Jeffrey Von Stein, CPIA, MAI, CRE