Expert Public Adjuster Expert Insurance Consultant Best Locally Based

The Homeowner's

ADVOCATE

INSURANCE CLAIM EXPERTS

FOR THE POLICYHOLDER!!

About Us

The HomeOwner's Advocate:

Jeffrey Von Stein, CPIA, AIC, CRE Chief Visionary Officer Licensed Public Adjuster Certified Insurance Appraiser Expert Loss Consultant

The HomeOwner's Advocate are " EXPERT" Insurance Claim Consultants, Licensed & Bonded Public Insurance Adjusters, Loss Consultants, and Insurance Claim Appraisers whom represent the interests of Policyholders in times of need. We are licensed and regulated by the Florida Department of Financial Services as we have a "Fiduciary Relationship" to represent our clients' best interests. Basically, Public Adjusters act as "The Coach" of the Property Insurance Claim process for the owners of the policies. As needed, Good LOCAL Public Adjusters have the best players on their team, ie. Roofers, Water Mitigation, Attorneys, Mold Mitigation, Engineers, etc. These relationships help to take the guesswork away from the HomeOwners inexperience. We are "The HomeOwner's Advocate".

Claim Denied or Underpaid?

Results Matter

Hurricane Damage Claims

Water Damage Claims

Wind Damage Claims

Roof Damage Claims

Flood Damage Claims

Fire Damage Claims

Mold Growth/Damage Claims

Hail Damage Claims

Licensed, Certified, and Specialized in all of the following areas:

Property & Insurance Claim/Damage Experts

Residential Claims

Commercial Claims

Insurance Appraisals

Contractor Evaluation & Vetting

Construction Consulting

Association Management, HOA Community Claims & Real Estate Portfolio Investors

We are your "Personal Expert Advocate. Why trust Angie's List, HomeAdvisor when these ratings can be "pay to correct"? In addition, many of these home service lead generators are being sued for not properly vetting their contractors. Insurance Claims happen so rarely, that you cannot afford to make any mistakes.

The process doesn't end with you getting a pile to money to make you "Whole". Don't be Victimized Again by not managing the restoration process correctly. Most Public Adjusters don't offer "Contractor Vetting and Management", but this is a often ignored "Crucial Step" in the entire process.

The HomeOwner's Advocate is truly like having your "Own Personal Advisor" guiding you from A to Z through the " Entire Process".

"Do it Once, Do it Right!!"

Current Clients Testimonials

Recent Client Successes

NEW CLIENT: November, 2024

Claim Type:

TORNADO DAMAGING WINDS GUSTS

Damage:

Severe Tornado Winds, Metal Roof Damages, Interior Water Penetration, Business Loss, Inventory Loss, Extra Expense Loss

Insurance:

LLOYDS of LONDON SURPLUS

Location:

St. Petersburg, FL

Results:

Multi-Use Multi-million dollar Warehouse and Boat Dry dock & Storage Facility. The claim had many moving parts and compensation areas from Structural Damages, Water Penetration, as well as Business Income Loss and Extra Expense. Was able to increase Total Settlement from Carriers' initial 360,000 to over 2.3 MIllion Dollars.

Client:

We interviewed 2 Public Adjusters and an Attorney, We chose The HomeOwner's Advocate due to his experience with similar types of Commercial Claims. In addition, he had over 20 years of Commercial Real Estate Experience in various avenues. His Experience added tremendous Value & Insight. Our Investors were Extremely Satisfied. Jeff, you can bring your Boat to us anytime, you like. Thanks Again.. Doug S. - Marina Boats Director of Ops.

March, 2022

Claim Type:

Hurricane Damage (Wind/Flood)

Damage:

Roof, Exterior, Interior, Flooding

Insurance:

HomeOwner's Choice

Location:

Navarre

Results:

We were able to increase and "Initial Denial" to over $165,000 in Final Settlement.

Client:

Jeffrey is what he preaches. An absolute Bull-Dog in Negotiations and not taking no for an answer, ever...

David D.-Pensacola

June, 2022

Claim Type:

Hurricane Damage (Wind/Tree)

Damage:

Roof, Tree Strike, Structural Issues

Insurance:

Tower Hill

Location:

Perdido Key, FL 32507

Results:

Able to bring in Foundation Engineers to substantiate a Complete Loss of Property for $375,000 Total Settlement, including $35,000 of Additional Living Expenses.

Client:

I was informed by insurance that my home

was repairable. Jeff was to allow me to get a

fresh start. Thanks you so much.

Howard D..-Perdido Key

NEW CLIENT: March, 2025

Claim Type:

HURRICANE WIND & FLOOD

Damage:

Severe Wind & Flood. House's foundation was "Racked" & Eventually ruled a "Constructive Total Loss".

Insurance:

FRONTLINE

Location:

Anna Maria Island, FL

Results:

Beach House was completely devastated and ripped off its Foundation "Racking". Able to run both Wind & Flood claim to maximize both claim. In addition, worked to get home deemed as a "TOTAL-LOSS", increasing Maximum Settlement amounts of over 1.2 Million Dollars.

Client:

I came across Jeff & The HomeOwner's Advocate at a "Pitfalls of Claim Negotiations" seminar he presented at our Anna Maria Island Community Center for many residents. I though since my house was ruined I'd get full compensation anyway and didn't need help. Two months later I called and he made me realize that I was missing a tremendous amount per both policies and getting deemed a "Constructive Total Loss. My advice: You Don't know what you Don't know? Hire Them ASAP...10 Stars.

August, 2023

Claim Type:

Hurricane (WIND)

Damage:

Damaged Roofs / Leaks

Insurance:

Multiple Carriers (5 Rentals)

Location:

Port Charlotte, FL

Results:

Able to substantiate New Roofs on 5 Rental Duplexes after all were full Carrier Denials.

Client:

Being a Realtor and Property Manager, I know lot of people. The HomeOwner's Advocate was able to bring in Roofing Experts to dispute the State of Florida's 25% Damaged Criteria the carriers were Defending. Success!! Scott P..-Port Charlotte, FL

July, 2024

Claim Type:

WIND / HAIL

Damage:

3 Bldg (20 Units) HOA Condominium Project

Insurance:

FRONTLINE

Location:

Panama City, FL

Results:

Was able to get a previously Denied Roof Replacement for all 3 buildings to full replacement ($78,000)

Client:

As the President of our Condominium HOA, I worked with Jeffrey to get our damages roofs replaced as we didn't have enough in our budget for them. He was able to pull off a Miracle. Thanks Jeff!!

NEW CLIENT - January, 2025

Claim Type:

WIND / Water Penetration

Damage:

8 Building (48 Units) HOA Condominium Project

Insurance:

FRONTLINE Surplus

Location:

Pensacola, FL

Results:

Was able to increase settlement from $27,000 to $356,000 while working with a scaled down Surplus Insurance Policy

Client:

As the President of the HOA, Jeff was amazing. He attended our Community Board Meeting and eased the concerns of the residents and kept them all informed of the progress. Extremely pleased with the End Result!!

NEW CLIENT - March 14, 2023

Claim Type:

Hurricane WIND

Damage:

Roof, Major Siding and Water Penetration

Insurance:

FRONTLINE

Location:

Sanibel Island, FL

Results:

After initial negotiations, Supplements, and eventually Appraisal, we were able to increase Policyholder from initial $36,000 to $324,000.

Client:

We were referred to Jeffrey VonStein of The HomeOwner's Advocate from a few of our friends on the island he was already working with. Our insurance carrier was absolutely abysmal in their initial offer, and we knew we needed professional help. Boy, did we make the right decision. At the end of the day, after supplement, after appraisal, we ended up with a significant overall settlement that i was extremely satisfied with. If I could give 10 Stars, I would...

Jeffrey Bonner.-Sanibel Island, Florida

NEW CLIENT - December, 2024

Claim Type:

Hurricane WIND

Damage:

Roof, Major Siding and Water Penetration

Insurance:

Progressive

Location:

Sarasota, FL

Results:

Was able to increase initial settlement from $13,000 to $97,000 after Appraisal Process.

Client:

Originally I had signed up with a General Contractor to assist with my claim. Realizing that they were not claim specialists, I was referred to The HomeOwner's Advocate. Jeff did an amazing job by extracting fair compensation from my unfair insurance company. Very pleased with the End Result.

NEW CLIENT - November 15, 2022

Claim Type:

Hurricane / FLOOD

Damage:

High Water-line Flood

Insurance:

FEMA

Location:

Punta Gorda, FL

Results:

Was able to previously Denied Claim to $145,000 after Attorney negotiations.

Client:

I couldn't believe my carrier denied my claim. What hat The HomeOwner's Advocate was able to do was simply Amazing. Thanks so much.

NEW CLIENT - March, 2025

Claim Type:

Water / MOLD Damage

Damage:

Water Penetration / MOLD Damage / Contents

Insurance:

USAA

Location:

St. Augustine, FL

Results:

Was able to increase settlement from $12,000 to $124,000 by Forensic Engineering Reports

Client:

Jeffrey was able to significantly increase a FAIR SETTLEMENT versus the carrier's ridiculous initial offer. Very pleased with his results and professionalism. He kept me informed throughout the entire process.

NEW CLIENT - February, 2025

Claim Type:

FIRE (ALE/Law & Ordinance)

Damage:

Fire Destroyed Home

Insurance:

State Farm Insurance

Location:

Tallahassee, FL 32317

Results:

Utilized significant Building Code knowledge to obtain an additional $55,000 for Law & Code, on top of a $475,000 total settlement.

Client:

Can't say enough about how your knowledge, expertise and careful guidance is helping me rebuild my life. Marge A...-Tallahassee, FL.

5 Star Reviews & Awards

Client Testimonials

What our clients say about us

⭐⭐⭐⭐⭐

⭐⭐⭐⭐⭐

⭐⭐⭐⭐⭐

⭐⭐⭐⭐⭐

⭐⭐⭐⭐⭐

⭐⭐⭐⭐⭐

⭐⭐⭐⭐⭐

⭐⭐⭐⭐⭐

I Highly Recommend The HomeOwner's Advocate Public Adjusters!!

⭐⭐⭐⭐⭐

FAQ

A Public Insurance Adjuster is a licensed and bonded insurance professional who assists policyholders with the complicated insurance claim process when they suffer an insured loss. Most Public Insurance Adjusters adhere to a strict Code of Ethics and are able to take advantage of the best quality, public adjuster specific, continuing education in the country. .

There are three types of adjusters licensed by the State of Florida:

Insurance Company Adjuster – is employed by an insurance company to represent the insurance company in dealing with your insurance claim. The insurance company adjusters main responsibility if to protect the interests of the insurance company.

Independent Adjuster – is hired by insurance companies to represent them in dealing with you, your loss and damages. The independent adjusters main responsibility is to protect the interests of the insurance company.

Public Adjuster – is the only Adjuster specifically licensed by the State of Florida to represent you, the Insured. The Public Adjusters main responsibility is to protect you and your interests in claims against a loss with the Insurance Company.

If you have just suffered an insured loss resulting from a pipe burst, a fire, hurricane or some other traumatic event, it’s probably not the best time to take a crash course on how to properly present an insurance claim. You may be dealing with a multitude of other matters, such as finding housing or an alternate business location, dealing with the emotional trauma of a loss or simply going about your daily responsibilities, like work and family. God forbid you should also be dealing with injuries or the unthinkable in connection with the event. Consider these three points.

It is up to you to prove the extent of your loss to the Insurance Company…

A typical insurance policy is dozens of pages long and contains numerous provisions and stipulations – written in technical and legal terms. Additionally, it contains various forms and endorsements which are constantly changing from year to year and which add or exclude coverage from your policy. Most people have difficulty understanding what can appear to be a lot of legal mumbo jumbo. For example, did you know that in order for the insurance company to compensate you for your loss, there are certain conditions which YOU must satisfy? Did you know that your failure to satisfy these policy requirements could reduce your settlement amount or even cause your claim to be denied? Don’t feel bad. Most people don’t know these things. A qualified and trained public insurance adjuster whom you trust can help make sure you meet all of the policy conditions, document your loss and get your claim paid.

No matter how organized you and your documentation is, filing and receiving payment on a claim is a time consuming and tedious process.

If you are not sufficiently organized and your loss documented, you may not realize the compensation you have paid premiums for and are entitled to receive.

A licensed, bonded and qualified Public Adjuster has the experience, knowledge and expertise to obtain your maximum entitlements under your policy.

Remember that the insurance company adjuster is representing the insurance company. It is not uncommon for the insurance company to misinterpret their own insurance policy or forget to apply case law or Florida Statutes which supersede their own policy. A public insurance adjuster will know current laws as they affect insurance losses and how to best represent you. A public insurance adjuster has resources to help you through the maze of estimating, documenting, and filing your insurance claims.

Yes you can. Be prepared to document all aspects of your loss, try to understand the insurance policy you purchased and follow through with the agent and the company. However, if your loss is significant (more than $10,000) you should consider hiring your own insurance professional, public Insurance adjuster to make sure you are properly represented. Remember, the insurance company has their own insurance professional expert representing them. Shouldn’t you have professional representation too?

Public Adjusters charge a percentage of the settlement for their service to you. The Public Adjuster is not paid until you are paid. There are no upfront fees for their services. Percentages vary from adjuster to adjuster, so it is best to shop for the best adjuster for you. The maximum percentage that a public adjuster in Florida can charge for a claim is 20% of the claim paid after you sign the contract with them. In the event of a declared emergency by the Governor’s office, that fee is reduced to 10% for any claim made in the first year after the date of loss. After the first year, the maximum amount that can be charged reverts back to 20%.

No they are not. Their services are available only to the insured public, not the insurance company.

The Insurance company is made up of a multitude of people. While there is definitely some friction between Public Adjusters and Insurance companies in general, most of the negative emotions will be expressed toward your Public Adjuster from people in the corporate office during the negotiation phase,* and you won’t have to hear about it. We are professionals and we don’t take it personally. Your Insurance Agent (the person who sold you your policy) most likely will have no dealings with your claim whatsoever, so there should be no hard feelings. As a matter of fact a lot of agents refer their clients to us, because they can’t legally represent the policyholder and they want to keep their clients happy.

The Insurance company can decide to drop you at any point in time, for any reason, besides personal discrimination (race, age, sexual orientation, etc.). Your rate can go up or they can drop you because they see you as a “high risk” customer. If you accidentally leave your iron on and it burns your house down, they can drop you due to “negligence”. Hiring a Public Adjuster does not change this for the better or worse. If your home is destroyed by an “act of God”, like a hurricane, then it’s not likely that they will drop you or raise your rate. On the up side, if you have wind damage and your entire roof is replaced, you should be able to negotiate a lower rate because you’re less likely to experience leaks and other claimable damages.

The purpose of insurance is to help people and organizations recover from the unexpected and to reduce the financial blow when the unexpected does occur. However, not all policies are created equal. Some might establish the value of damaged property based on its actual cash value (ACV), while other policies might settle based on the replacement cost or a predetermined amount. Its easier way to think about

ACV is to consider it as the used value of the property, while replacement cost value is the price to replace the item as new in today’s marketplace. The difference between ACV and RCV is the Depreciation due to age. While depreciation is applied in ACV-based policies, deprecation is recoverable on HO-3 type policies (the most common home insurance policy).

License & Appointment – Make sure their license and appointment are up-to-date with the State of Florida and make sure they are really a licensed Public Adjuster. Some people are misrepresented themselves as Public Adjusters. Check here (add link to https://licenseesearch.fldfs.com)

Experience – Public Adjusters come from a wide range of backgrounds – Ask about experience and training and it’s always a good idea to ask for references. Make sure the person who you are considering has the right mix for you.

Professionalism – Do not sign blank contracts. A professional public insurance adjuster will explain the fee structure up-front so you understand why and what you’re are paying for.

Comfort Level – This intangible may be quite important if your claim is complex or extensive. This person will be helping you through a very traumatic time and resolving the claim could take some time…find someone who fits your needs.

An insurance property appraisal is a documented assessment of a property’s replacement value by an insurance appraiser, which is a completely different profession than a property appraiser. Many times home and business owners find themselves in disagreement with the insurance company on the extent of property damages or the amount of money it will cost to repair the damages they’ve experienced during a loss. When the insurance company refuses to bend, you have the option to demand appraisal. The Appraisal Clause, also known as The Appraisal Provision, allows you to have two third-parties separate from the Insurance Company voice their opinion on your damages, and amount to be paid. It’s been described sort of like a court arbitration, but without courtrooms, lawyers, or judges.

Most policies have an “Appraisal Clause”. You can usually find it in your policy under the “Conditions” or “What to do after a loss” segment. If you have trouble finding it, call one of our specialists, who can assist you. An Appraisal Clause will usually read something like this:

“If you and we fail to agree on the amount of loss,(Either Party or Both Parties Must Agree) may demand that the amount of the loss be set by appraisal. If either makes a written demand for appraisal, each shall select a competent, independent appraiser. Each shall notify the other of the appraiser’s identity within 20 days of receipt of the written demand. The two appraisers shall then select a competent, impartial umpire. If the two appraisers are unable to agree upon an umpire within 15 days, you or we can ask a judge of a court of record in the state where the residence premises is located to select an umpire. The appraisers shall then set the amount of the loss. If the appraisers fail to agree within a reasonable time, they shall submit their differences to the umpire. Written agreement signed by any two of these three shall set the amount of the loss.”

Insurance mediation refers to the process of settling disputes arising from certain types of insurance claims. The dispute will be between the insured and the insurer. The Insurance company will have a representative to argue their prospective and thoughts on an insurance claim and the policyholder should have a representative to argue their prospective and thoughts on the claim. Both representatives and the policyholder come together at a scheduled time and place and hash out what a fair allotment will be. Sometimes claims are settled right then and sometimes you reach a stalemate and another approach will have to be taken to further the claim.

The HomeOwner’s Advocate, as your representative will schedule and go to this meeting on your behalf. Whether the claim is settled then or later, it’s just another avenue that can be used in the negotiation process of your claim. You must have retained The HomeOwner’s Advocate via contract in order to have them represent you in mediation for your claim. If you have a mediation scheduled and need our services, please contact us immediately.

Negotiation* time can range from a few days to a few months, it really depends on how efficient your insurance company is. During this process our office staff will contact them almost daily by phone and e-mail to check the status of your claim, and to ensure that they are working on it steadily. Notes and status updates are recorded in our library of files, where you can login and see what’s happening with your claim. During a catastrophe, such as a hurricane, processing time can slow down drastically because of the influx of thousands of claims. Ideally a residential, non-catastrophic claim would be completed in 90 days. A multi-million dollar commercial property catastrophic claim can last up to two years, depending on the details. Because there are so many variables, it’s very difficult to say how long it will take for your specific claim. There are a variety of paths your claim can go. Each with it’s own set of Pitfalls. The HomeOwner’s Advocate will help you successfully Navigate through all paths, Negotiation, Mediation, Appraisal, Arbitration, and Attorney.

You’ve paid your insurance company for years so don’t settle for less than what you’ve paid for now that it’s their turn to take care of you. We’ll fight to get you the full relief that your insurance policy has promised you.

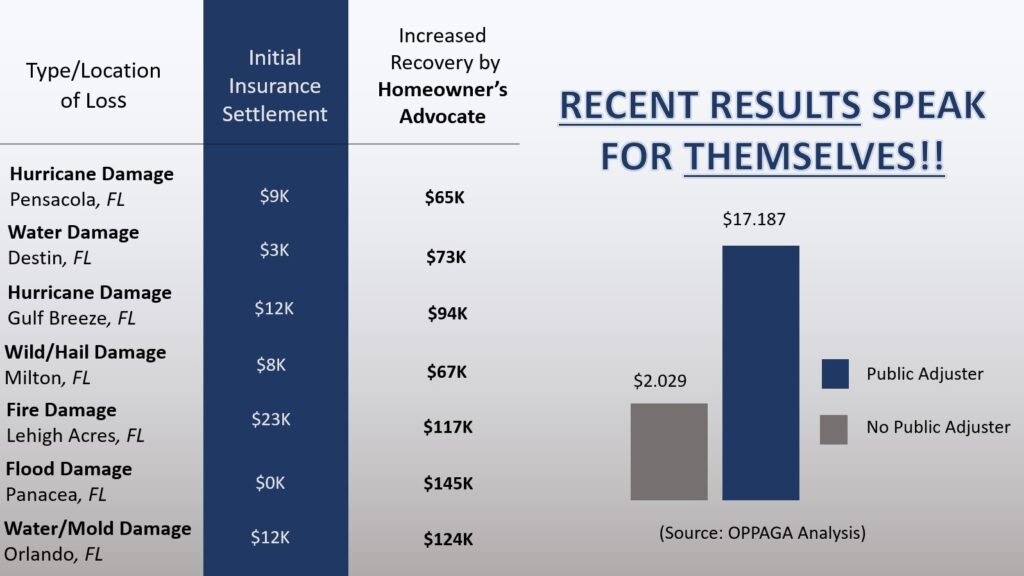

A study performed by The Office of Program Policy Analysis and Government Accountability (OPPAGA) determined that policy holders who use a Public Adjuster receive a 747% higher claim pay-out than those who choose to file their claims alone.

Some states, like Florida, seem to be indicating that public adjusters act as fiduciaries for their policyholder clients. Florida case law refers to public adjusters as a fiduciary. Many Policyholders might wonder—“What does it mean to act as a fiduciary?”

Fiduciaries hold a critical role in various contexts, such as legal, financial, and trust-related matters. The law regarding fiduciary duties varies between each state. The exact duties of a public adjuster acting as a fiduciary may not be defined by regulation or thoroughly examined by the law, but their typical duties, which are grounded in trust and ethical conduct, include:

Duty of Loyalty: This is perhaps the most fundamental duty of a fiduciary. It requires the fiduciary to act solely in the best interests of the policyholder client, above their own interests or the interests of third parties. This means avoiding conflicts of interest and not profiting from their position as a public adjuster at the expense of the policyholder.

Duty of Care: A fiduciary must exercise a high standard of care in managing the assets or affairs of the beneficiary. This involves making informed and prudent decisions, like how a reasonably cautious person would manage their own affairs. It includes conducting thorough research and due diligence before making decisions.

Duty to Act in Good Faith: Fiduciaries are required to act honestly and in good faith when dealing with policyholder clients. This means being transparent, providing accurate information, and not misleading or deceiving the policyholder in any way.

Duty to Provide Information: A fiduciary should keep the beneficiary informed about relevant information concerning their assets or interests. This includes regular updates and reports on the status of the adjustment or any actions taken on their behalf. Public adjusters should not withhold information from their clients gained in the performance of their duties.

Duty of Confidentiality: Fiduciaries must maintain the confidentiality of information related to the policyholder or their claims. They should not disclose any sensitive information without proper authorization or legal requirement.

Duty to Avoid Conflicts of Interest: A fiduciary must avoid situations where their personal interests conflict with those of the policyholder. If a conflict of interest arises, a fiduciary is typically required to disclose this conflict and, in many cases, recuse themselves from the decision-making process related to the conflict.

Duty to Act According to the Terms of the Fiduciary Agreement: Fiduciaries must adhere to the terms and conditions set forth in the agreement or legal instrument that established the fiduciary relationship. This includes following any specific instructions or guidelines stated in the contract.

Duty to Not Comingle Funds: Public adjusters must keep the beneficiary’s funds and property separate from their own. Commingling of funds can lead to conflicts of interest and mismanagement of assets. A number of states state that a public adjuster must act as a fiduciary only in this capacity. The omission of regulations stating that the duty expands into other areas may suggest that a public adjuster may not be deemed a fiduciary in those jurisdictions.

Duty to Be Impartial: If a public adjuster serves multiple policyholders, they must treat all fairly and impartially. They should not favor one policyholder over another unless explicitly directed by the terms of the retention agreement.

The journey of a licensed public adjuster is one marked by stringent regulations and high ethical standards. Most states recognize that the work of public adjusting is not just a profession but a solemn commitment to the public trust. This responsibility demands the utmost ethical conduct to ensure that the work is done correctly and legally.

There is, indeed, no higher calling than upholding a fiduciary duty. It is a role that requires not just expertise but a steadfast commitment to integrity and fairness. Public adjusters must, therefore, establish business practices that are in strict alignment with these lofty standards.

The path of a public adjuster is challenging and laden with responsibilities that go beyond the ordinary. It is a role that demands not just skill but a deep sense of duty and a commitment to doing what is right, even when it is not easy. This is a path for those willing to shoulder the weight of trust placed in them by the public. To be a public adjuster is to be at the forefront of advocating for those in need, to be a beacon of hope and fairness in the often complex world of insurance claims. It is a chance to make a real difference, to stand up for justice, and to guide those who are lost in the maze of policies and procedures. In embracing these challenges and the corresponding ethical duties, public adjusters can find a sense of accomplishment and purpose that goes beyond the ordinary. It is a journey that is not just about navigating the intricacies of insurance claims but about upholding the principles of trust and integrity. It is hard work, undoubtedly, but it is also work that has the power to change lives and make a lasting impact.

Actual Cash Value (ACV)

The amount of money needed to fix your home, minus the decrease in value of your property because of age or use. This is also called Depreciated Cash Value.

Replacement Cost Value (RCV)

The amount of money needed to repair your home at today’s prices of building supplies; or replace your belongings at today’s cost of the similar or like item. It is important to discuss replacement cost with your insurance agent when purchasing your policy.

How Replacement Cost Works

Generally, if you have Replacement Cost Coverage, the insurance company may first pay you the actual cash value. Once the item is repaired/replaced and receipt(s) submitted, the company will reimburse you the extra money you paid to replace/repair the item. This is called “Recoverable Depreciation.” It is important to know how your policy will pay replacement cost.

ACV is typically calculated in one of three ways:

- The cost to repair or replace the damaged property, minus depreciation.

- The damaged property’s “fair market value.”

- Applying the broad evidence rule, which calls for “the selection of that ‘value,’ which, in the event of a total loss, will provide complete indemnification and no more,” according to IRMI. Not every state allows for this. This could be the replacement cost, estimate profits the property would have turned or the tax value.

An often overlooked portion of insurance claims is for Additional Living Expenses, commonly referred to as “ALE,” and Loss of Use. This coverage comes into play when you’ve sustained a covered loss to property that renders it uninhabitable. As you might guess, uninhabitable can be a term of art and depends greatly on the type of damages to the property and the individual living in the property.

If the proper procedure isn’t followed for these coverages you could be losing money from your hard earned savings, or losing money on your rental property that you might never see again.

What does my policy cover?

Additional Living Expenses

When the property you live in is rendered uninhabitable, either by an infestation of mold, an inundation of water, significant fire or smoke damage, lack of working or usable plumbing, health concerns related to damages or repairs, or even when a significant portion of the property is unusable during repairs, then you may have a claim for Additional Living Expenses.

From here forward, it’s important that you keep an open line of communication with your insurance company before incurring any Additional Living Expenses. Placing them on notice of the claim is one of the easiest ways to prevent future disputes. Many insurance companies have departments dedicated to helping accommodate you. Honestly, when insurers that have a department or liaison, that person is often the most helpful person you’ll ever deal with at an insurance company.

It’s also worth noting many policies vary in your requirements to be reimbursed for these types of costs. If you’re not thoroughly familiar with your policy, it’s best to have someone help you navigate this potential mine field. Why?

These types of expenses are only reimbursed as you’ve incurred them, and if you’re not pre-approved, you’re out that money indefinitely (which is until the insurance company decides to pay, either through settlement or litigation)!

So, what’s covered?

Typically, if you have to move out rental costs are reimbursed for either a hotel or comparable dwelling for the shortest period of time required to actually repair your property. You’re obligated under your policy to mitigate your damages, and that includes your living expenses. If a monthly rental is cheaper than a week in a hotel for a family of six and their three pets, then that’s the sensible option and more likely to be reimbursed. Just because you’ve suffered a loss in your home and the insurance company is picking up the tab doesn’t mean you’re getting a vacation on someone else’s dime. Sometimes, insurance companies will arrange for direct payment to a landlord, hotel or rental agency.

-Extra fuel and/or mileage is reimburseable if you have to travel a farther distance than normal to the places you regularly travel like work, meetings, school, etc.

-Meals may be reimbursed, whether or not you’re out of your home, but it can depend. If you typically eat all of your meals in restaurants or take-out, these meals aren’t “additional expense” as a result of your claim. If you normally cook at home but no longer have the use of your kitchen, it should be reimbursed. Be prepared to prove this. And, no. Alcohol and tobacco products are not reimbursed.

-Increases in electric or water bills may be reimbursed under certain circumstances. Often times emergency service contractors running high powered fans for a week will cause a spike in your power bill that can be considered part of your insured loss.

-Laundry costs, storage, pet boarding, and a number of other items may also be considered.

What’s not covered?

-Additional Living Expenses are NOT a form of insurance for pain and suffering or loss of your time in meeting with insurance adjusters, contractors, etc. Likewise, delays in your claims are not reimburseable as Additional Living Expense as a form of “punitive damage.”

-You cannot live in a tent in your backyard and expect to earn a paycheck as a reward for “roughing it.” (Yes, we’ve had more than one client propose this to us…)

-The insurance company will not pay you to live in another vacant property you own if it was already vacant or scheduled to be.

-You will not be reimbursed for purchasing a trailer, RV, motorhome or other vehicle, or second/seasonal home or rental property. The purpose of insurance is to make you whole and if you’re reimbursed for purchase, or a portion of a purchase for something you’d get to keep later on. This is called “betterment,” and is against the entire principle of insurance.

-Most importantly, you will not be paid to live with a friend or family member for free. If you are intending to stay with a friend or family member while you must be out of your home, you must be paying for the privilege of doing so, and, again, be prepared to prove it. If you attempt to stay with someone for free, claim you’ve incurred expense in doing so and the insurance company proves you have not paid, you have committed insurance fraud, which is a felony, and will likely jeopardize the coverage for the rest of your claim as well.

Loss of Use

The term “Loss of Use” may be used interchangeably with Additional Living Expenses, but may also refer to reimbursement of fair rental value for a property insured for this type of occupancy. In order to obtain this type of coverage if your rental property is uninhabitable, you must have either a commercial policy designating a property for rental, or a dwelling (“landlord”) policy. If you own a rental property, make sure this coverage exists with your agent. If you’ve rented a property that you formerly occupied with a homeowners policy, your insurance company may have grounds to void your coverage for an unauthorized change in occupancy and risk.

If you do have a valid claim for Loss of Use, your tenant must have vacated as a result of an insured loss, or an insured loss must have prevented a pending occupancy from taking place. The reimbursement is typically based off the price in a documented rental agreement or lease. You can’t argue that you were renting below market value and should get more. The purpose is to make you whole, not rectify a less than desirable lease. Likewise, if the property was not rented and there was no pending tenant, the coverage doesn’t apply to a non-existent tenant.

Yes! We’d be glad to. If you’d like any recommendations as to someone else you might need a service from, whether related to your loss/claim, or just in general, we’d be happy to let you know who we’ve worked with, who we trust, and give an honest opinion of anyone’s services we’re familiar with.

The HomeOwner’s Advocate is one of the few Public Adjusting firms whom offer ‘Contractor Vetting”. What good is it for us to get you a Pile of Money, only to have a Contractor siphon it away from you? We also have some of the “Best in Class” Appraiser and Attorney” relationship should they be need to carry the ball over the “Goal-Line”

We will never pressure you to choose someone we’ve recommended or referred and will always honestly disclose our relationships with whomever we’re referring. The decision is always up to you to work with whomever you’re most comfortable with.

At the end of the day, our business relies on word of mouth advertising from our past and present clients, so its in our best interest to make sure you’re happy, and the same holds true when we’re recommending someone for you to do business with. If we recommend someone that doesn’t take care of you, that costs us business.